Indias first nasal vaccine for Covid-19. Use in programming languages.

0735 Gurugram Police personnel illegally occupying EWS flats asked to vacate.

. Todays POS system go beyond processing sales. As per Notification No. In addition actual conveyance and out of pocket expenses to be recovered.

Crèche facility to be near establishmentevery establishment having fifty or more employees shall have the facility of crèche within a distance of five hundred meters from the main entrance of the establishment. AND SAC stands for Service Accounting Codes which are adopted by. HSN Code List for GST in pdf HSC Codes in Excel Format Find HSN Code for Your Business.

As the sales of gift cards is increasing every year your POS system must have the capability to manage those as well. Strings are typically stored at distinct memory addresses locations. 0713 Tamil Nadu tops in number of senior citizens murders in 2021.

He of course omitted to mention that his Government has increased GST from 7 to 9 adding 2 to household budget costs by 2024. As a general rule an income tax deduction is available for the cost of providing entertainment that is a fringe benefit ie. Thus the same string.

Loyalty programs and gift cards. U-Save rebates give back maybe 10 of the increase in utility costs due to skyrocketing energy prices while SingPower is on track to make record profits as is Singapore Petroleum. This is effected under Palestinian ownership and in accordance with the best European and international standards.

In the hands of donor. The trauma of French colonial rule in Algeria and the bitter independence war that ended it in 1962 has haunted relations between the two countries for decades and played into a diplomatic dispute that erupted last year. Order 7 rule 11 Locus Standi.

Centre consented to release convicts early says lawyer. 0717 Bilkis Bano case. In most programming languages strings are a data type.

In this case the e-Commerce Operator should have been registered on the GST portal as e-Commerce Operator and pass eCom_GSTIN accordingly. It assists as a comprehensive indirect tax which helps in eliminating the flowing effect of tax as a whole. The Honble Supreme Court after hearing the two sides in perspective on the realities of the case held that the Law of Limitation unequivocally restricts this suit.

The Petitioners were unable to file Form GST TRAN-1 within the due date prescribed under Rule 117 of the Central Goods and Services Tax Rules 2017 CGST Rules to carry forward accumulated input. The GST rate of the hotels with a tariff between Rs 1001 and RS 7500 per night is 12 and GST rate for hotels with tariff equal to or above Rs 7501 per night is 18. Rs10000GST per location with a cap of Rs200000-GST per annum for all locations put together.

GST - Know about Goods and Services Tax in India with various types and benefits. New promotional products have returned with the PWP. If you are looking for a cheapest courier service from Singapore to Malaysia than we are here to help you Yes.

The two types of taxes in India are Direct and Indirect taxes. To file a suit the offended party needs to have a locus standi. Goods and Service Tax is the biggest reform in the structure of Indirect Tax in India since the market began unlocking 25 years back.

It is a tax imposed on corporate units and individual people. As per section 562x of the Income Tax Act 1961 any person who receives the shares by way of gift shall having total fair market value exceeding INR 50000- shall be considered as deemed income in the hands of done. For accounts with limits of Above Rs10 Cr.

0748 Top headlines. So you can create a great difference here. In the Maternity Benefit Mines and Circus Rules 1963 after rule 6 the following rule shall be inserted namely 6A.

One of the biggest and most successful tax reforms in India is the GSTGoods and Services Tax. NOTICE PAKISTAN Operate by Enagic Malaysia Sdn Bhd. 7500 still continue to pay 18 GST and enjoy ITC.

Receives a gift from Boualem Benhaoua 2nd left owner of the disco Maghreb Shopin mythical label of rai music during. One important thing that every traveler should know is that hotels in India have different GST rates depending on their tariff. Check out our HSN Code finder HSN stands for Harmonized System of Nomenclature which is an internationally accepted product coding system used to maintain uniformity in the classification of goods.

Fines and penalties imposed under any Australian and foreign law are generally not deductible. PROMO Be at ease. Instead of using traditional punch cards you can now track your customer loyalty incentives using the POS system.

However restaurants as part of hotels with room tariffs exceeding Rs. In case the supplier is SEZ unit then he cannot generate e-Invoice. Gift of shares is exempt in the hands of donor in terms of section 47 of the Income Tax Act 1961.

We provide cheapest way to send a parcel to Malaysia from SingaporeThere are many things we courier to Malaysia every day from Singapore people need a secure and reliable shipping service for courier to Malaysia. New seat belt rule. McDonalds charges 5 GST and cannot claim any ITC.

In context-free grammars a production rule that allows a symbol to produce the empty string is known as an ε-production and the symbol is said to be nullable. Cheapest Courier Service from Singapore to Malaysia. EUPOL COPPS the EU Coordinating Office for Palestinian Police Support mainly through these two sections assists the Palestinian Authority in building its institutions for a future Palestinian state focused on security and justice sector reforms.

The Income Tax Act of 1922 was prevalent during the British Raj and was inherited by both the governments of India and Pakistan upon independence and partition in 1947. Check GST rates registration returns certification and latest news on GST. Whats more the plaint should be dismissed under Order VII Rule 11 of CPC.

The app will also include rewards like gift packs from Kudumbashree and Vanashree and KTDC vacation packages in addition to cash rewards. History The Income Tax Act of 1922. Reverse Charges can be set as Y in case of B2B and SEZ invoices only and tax is being paid in reverse manner as per rule.

Goods and Service Tax-GST. 462017-Central Tax Rate dated 14th November 2017 standalone restaurants will charge only 5 GST but cannot enjoy any ITC on the inputs. The goods and services tax is a consumption-based tax because it is chargeable where the consumption is.

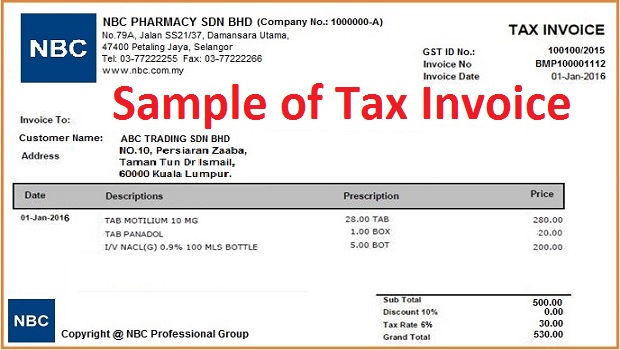

Malaysia Goods And Services Tax Gst Penalties Goods Services Tax Gst Malaysia Nbc Group

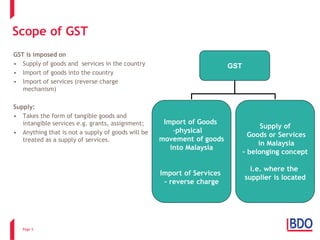

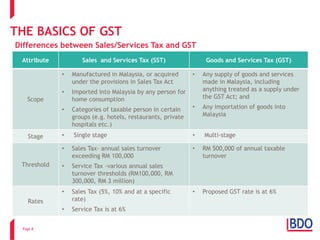

Preparing Business For The Transition Towards Gst Gst Unit Royal Malaysian Customs Department Ppt Download

Pdf Goods And Services Tax Gst The Importance Of Comprehension Towards Achieving The Desired Awareness Among Malaysian

Frequently Asked Questions Malaysia Gst 6 To 0 Transition

Pdf Goods And Services Tax Gst Challenges Faced By Business Operators In Malaysia

Gst Can Help Those Hit By Pandemic Says Najib Free Malaysia Today Fmt

Chocolate Passion April Fool S Day Promotion In Malaysia April Fools Day April Fools Chocolate

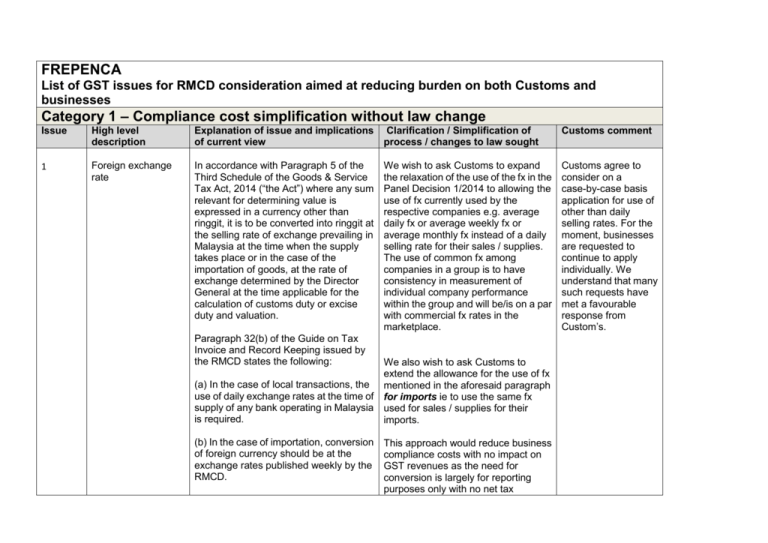

Gst Meeting With Customs Officials On 20150209

Pdf The Adoption Of Gst In Malaysia Lessons Not Learned And A Few New Paths

Free Resources Archives Goods Services Tax Gst Malaysia Nbc Group